Launching a Profitable Personal Finance Blog in 2024

As we navigate through an ever-changing financial landscape, the need for reliable and accessible personal finance information has skyrocketed. In an era where economic uncertainties abound, and financial literacy is paramount, personal finance blogs have emerged as a powerful resource for individuals seeking guidance on managing their money effectively.

This comprehensive guide will take you on a journey through the process of starting a successful personal finance blog, covering every aspect from conceptualization to monetization. Whether you're a financial enthusiast, a budding entrepreneur, or someone seeking to share your expertise, this article will equip you with the knowledge and strategies to create a thriving online presence in the personal finance niche.

Importance of Starting a Personal Finance Blog

Starting a personal finance blog presents a unique opportunity to not only share your financial wisdom but also to empower others to take control of their financial well-being. By providing valuable insights, practical tips, and relatable experiences, you can become a trusted voice in the personal finance community, inspiring and guiding individuals towards financial freedom.

Understanding Personal Finance Blogging

Personal finance blogging involves creating and sharing content related to various aspects of money management, such as budgeting, saving, investing, debt reduction, retirement planning, and more. It serves as a platform for individuals to share their knowledge, experiences, and insights on navigating the complexities of personal finance.

Benefits of Starting a Personal Finance Blog

Starting a personal finance blog offers numerous advantages, including:

1. Establishing Authority: By consistently providing valuable and engaging content, you can position yourself as an authority in the personal finance domain, attracting a loyal audience and potential business opportunities.

2. Passive Income Generation: A well-established personal finance blog can generate passive income through various monetization strategies, such as affiliate marketing, sponsored content, and advertising.

3. Networking and Collaboration: The personal finance blogging community fosters connections with like-minded individuals, opening doors for valuable collaborations, guest posting opportunities, and cross-promotion.

4. Personal Growth and Accountability: Blogging about personal finance encourages self-reflection, discipline, and a deeper understanding of financial concepts, ultimately enhancing your own financial literacy.

Common Misconceptions Debunked

1. “Personal finance blogging is oversaturated.” While the personal finance niche is competitive, there is always room for unique voices and perspectives. By carving out a distinct niche and offering valuable content, you can stand out from the crowd.

2. “You need to be a financial expert.” While having a strong financial background is beneficial, personal finance blogging is accessible to anyone with a genuine passion for the subject and a willingness to learn and share their experiences.

3. “Blogging is a get-rich-quick scheme.” Building a successful personal finance blog requires consistent effort, dedication, and a long-term mindset. Sustainable income generation takes time and strategic planning.

Planning Your Personal Finance Blog

Identifying Your Target Audience

Before embarking on your personal finance blogging journey, it's crucial to identify your target audience. Understanding their specific needs, pain points, and interests will enable you to create content that resonates with them effectively.

1. Demographics: Consider factors such as age, income level, financial goals, and life stages (e.g., students, young professionals, families, retirees).

2. Interests: Identify the specific financial topics that your audience is most interested in, such as budgeting, debt management, investing, or retirement planning.

3. Psychographics: Analyze the values, attitudes, and behaviors that shape your audience's financial decisions and preferences.

Choosing Your Niche within Personal Finance

While personal finance is a broad topic, carving out a specific niche can help you stand out and attract a dedicated following. Consider exploring niches such as:

– Frugal living and minimalism

– Investing and wealth-building strategies

– Debt management and credit repair

– Personal finance for specific demographics (e.g., families, millennials, women)

– Entrepreneurship and side hustles

– Retirement planning and financial independence

By focusing on a well-defined niche, you can establish yourself as an authority and provide highly targeted and valuable content to your audience.

Setting Clear Goals for Your Blog

Defining clear goals for your personal finance blog is essential for staying motivated and measuring your success. Consider the following objectives:

1. Building an engaged community of readers

2. Generating a sustainable income stream

3. Establishing yourself as an authority in the personal finance space

4. Promoting financial literacy and empowering others

5. Creating a platform for potential speaking engagements, consulting, or coaching opportunities

Setting Up Your Personal Finance Blog

Choosing a Domain Name and Hosting Provider

Your domain name and hosting provider are the foundation of your online presence. Choose a domain name that is memorable, relevant to your niche, and easy to spell and pronounce. When selecting a hosting provider, consider factors such as reliability, speed, security, and customer support.

Selecting the Right Blogging Platform

The blogging platform you choose will determine the functionality, design, and scalability of your personal finance blog. Popular options include WordPress, Blogger, and Squarespace. WordPress, in particular, offers a wide range of customization options, plugins, and themes, making it a popular choice among bloggers.

Designing Your Blog for User Experience

A visually appealing and user-friendly design is crucial for engaging your audience and keeping them on your site. Consider the following elements:

1. Clean and responsive layout for optimal viewing on various devices

2. Easy navigation and intuitive menu structure

3. Incorporation of relevant visuals, such as images, infographics, and videos

4. Consistent branding and visual identity

5. Optimization for search engines and fast loading times

Creating High-Quality Content

Developing a Content Strategy

A well-defined content strategy is essential for consistently producing engaging and valuable content for your audience. Consider the following elements:

1. Content pillars: Identify the main topics or categories you'll focus on (e.g., budgeting, investing, debt management).

2. Content types: Diversify your content by incorporating blog posts, videos, podcasts, infographics, and downloadable resources.

3. Content calendar: Plan and schedule your content in advance to maintain a consistent publishing schedule.

4. Search engine optimization (SEO): Incorporate relevant keywords and optimize your content for search engines to improve visibility and organic traffic.

Writing Engaging and Informative Blog Posts

Crafting compelling blog posts is the backbone of your personal finance blog. Consider the following tips:

1. Know your audience: Write in a tone and style that resonates with your target audience.

2. Research and fact-checking: Ensure your content is accurate, up-to-date, and supported by credible sources.

3. Storytelling and personal experiences: Share relatable stories and personal experiences to connect with your readers emotionally.

4. Clear and concise writing: Break down complex financial concepts into easy-to-understand language.

5. Calls-to-action: Encourage reader engagement by asking questions, prompting comments, or suggesting next steps.

Incorporating Visuals and Multimedia

Visual elements and multimedia can enhance the overall experience and engagement of your personal finance blog. Consider incorporating:

1. High-quality images and infographics to break up text and illustrate concepts

2. Videos and screencasts for step-by-step tutorials or interviews with experts

3. Podcasts or audio content for on-the-go consumption

4. Interactive calculators and tools to help readers with financial calculations

Building Your Audience

Promoting Your Blog on Social Media

Social media platforms are powerful tools for promoting your personal finance blog and connecting with your audience. Develop a presence on relevant platforms such as Twitter, Facebook, Instagram, and LinkedIn, and engage with your audience by:

1. Sharing new blog posts and valuable content

2. Interacting with comments and responding to queries

3. Participating in relevant online communities and discussions

4. Collaborating with influencers and other bloggers in your niche

Engaging with Your Audience through Comments and Emails

Building a strong connection with your audience is essential for sustaining a successful personal finance blog. Actively engaging with your readers through comments and emails can foster a sense of community and loyalty.

- Respond promptly to comments: Acknowledge and respond to comments on your blog posts in a timely manner. This shows your audience that you value their input and encourages further engagement.

- Encourage discussions: Ask thought-provoking questions and invite readers to share their experiences and perspectives. This can lead to insightful discussions and deeper connections.

- Address reader inquiries: Regularly check your email inbox and respond to reader questions or concerns. This personalized attention can strengthen your relationship with your audience.

- Seek feedback: Periodically solicit feedback from your readers about the content they find most valuable, topics they'd like to see covered, or areas for improvement. This input can help shape your content strategy and better serve your audience's needs.

Networking with Other Bloggers and Influencers

Collaborating with other bloggers and influencers in the personal finance space can help expand your reach and credibility. Consider the following strategies:

- Guest blogging: Offer to contribute guest posts on other popular personal finance blogs, and vice versa. This can introduce you to new audiences and establish mutually beneficial relationships.

- Interviews and expert roundups: Participate in expert roundups or interviews with other bloggers or influencers. This not only exposes you to their audience but also positions you as an authority in your niche.

- Cross-promotion and link-building: Support fellow bloggers by sharing their content on your social media channels, and in return, they may share your content with their audience.

- Attending industry events: Participate in personal finance conferences, meetups, or online communities to network with other professionals and build connections.

Monetizing Your Personal Finance Blog

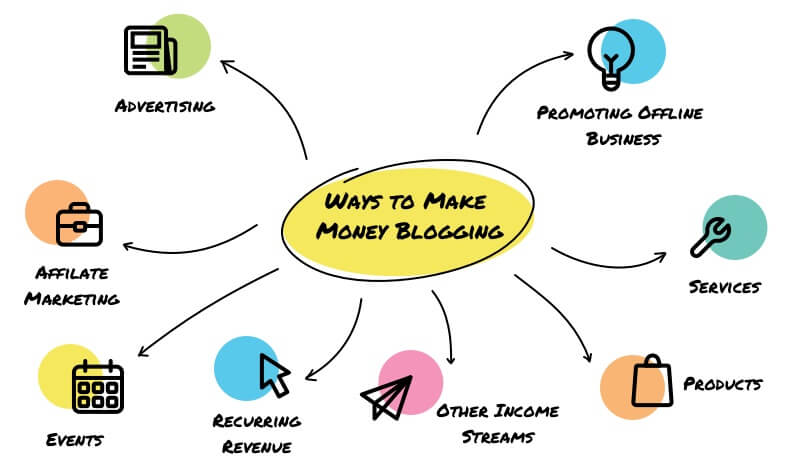

Introduction to Monetization Strategies

While sharing valuable content should be the primary focus, monetizing your personal finance blog can provide a sustainable income stream and allow you to dedicate more time and resources to your passion. There are various monetization strategies to explore:

- Affiliate marketing

- Display advertising

- Sponsored content and partnerships

- Digital products (e.g., e-books, courses, templates)

- Consulting or coaching services

- Membership programs or premium content

Implementing Affiliate Marketing on Your Blog

Affiliate marketing is a popular monetization strategy for personal finance bloggers. By promoting relevant products or services and earning a commission on qualifying sales or sign-ups, you can generate passive income.

- Identify relevant affiliate programs: Research and join affiliate programs that align with your niche and audience's interests (e.g., financial tools, investment platforms, budgeting apps).

- Disclose affiliate relationships: Transparency is crucial. Clearly disclose your affiliate relationships to maintain trust with your audience.

- Provide genuine value: Only promote products or services you truly believe in and can personally recommend. Your credibility is paramount.

- Seamless integration: Incorporate affiliate links naturally within relevant blog content, reviews, or resource pages, without compromising the reader experience.

Exploring Other Income Streams such as Display Advertising and Sponsored Content

Display advertising and sponsored content are additional revenue streams to consider for your personal finance blog:

- Display advertising: Partner with ad networks or directly with advertisers to display banner ads, sponsored links, or other forms of advertising on your blog. Ensure the ads are relevant and non-intrusive.

- Sponsored content: Collaborate with brands or companies to create sponsored posts, product reviews, or branded content that aligns with your niche and audience.

- Paid partnerships: Explore opportunities for paid partnerships with relevant brands, such as affiliate programs, influencer campaigns, or brand ambassadorships.

- Leveraging your expertise: Offer consulting services, coaching programs, or paid speaking engagements leveraging your personal finance expertise.

Legal and Financial Considerations

Understanding Legal Obligations for Bloggers

As a personal finance blogger, it's essential to understand and comply with relevant legal obligations to protect yourself and your audience. Consider the following:

- Disclaimers and disclosures: Clearly state that the information provided on your blog is for educational purposes only and does not constitute financial advice. Disclose any conflicts of interest or affiliations.

- Privacy policies and terms of use: Implement privacy policies and terms of use to outline how you collect, use, and protect user data and to establish the rights and responsibilities of both parties.

- Intellectual property and copyrights: Respect intellectual property rights by obtaining proper permissions or licenses for using copyrighted materials, such as images, videos, or written content.

- Legal entity and licensing: Depending on your monetization strategies and business goals, you may need to register as a legal entity (e.g., LLC or corporation) and obtain necessary licenses or permits.

Managing Taxes and Finances as a Blogger

Once your personal finance blog starts generating income, it's crucial to manage your taxes and finances properly:

- Record-keeping: Maintain accurate records of your income, expenses, and any applicable deductions related to your blogging business.

- Tax obligations: Understand and comply with relevant tax laws and regulations, including self-employment taxes, income taxes, and sales taxes (if applicable).

- Financial planning: Develop a financial plan for reinvesting a portion of your blogging income into scaling your business or diversifying your income streams.

- Professional assistance: Consider seeking guidance from a tax professional or financial advisor, especially as your blog grows and your financial situation becomes more complex.

Ensuring Transparency and Compliance

Building and maintaining trust with your audience is paramount for the success of your personal finance blog. Ensure transparency and compliance by:

- Disclosing sponsored content or affiliate relationships clearly and prominently.

- Fact-checking and providing accurate, up-to-date information from reputable sources.

- Avoiding deceptive or misleading claims, especially when discussing financial products or services.

- Respecting privacy and maintaining the confidentiality of any personal information shared by your audience.

Scaling Your Personal Finance Blog

Strategies for Growth and Expansion

As your personal finance blog gains traction and establishes a dedicated following, it's essential to explore strategies for growth and expansion:

- Diversifying content formats: Expand your content offerings by introducing new formats such as video tutorials, podcasts, or webinars to cater to different learning preferences.

- Expanding into new niches or topics: Identify related niches or subtopics within personal finance that align with your audience's interests and provide opportunities for growth.

- Collaborations and partnerships: Seek out collaborations with complementary businesses, influencers, or brands to reach new audiences and tap into additional revenue streams.

- Building an email list: Cultivate an engaged email list to directly communicate with your audience, share exclusive content, and promote products or services.

Leveraging Automation and Technology

As your personal finance blog grows, leveraging automation and technology can streamline processes and enhance efficiency:

- Content management systems: Utilize robust content management systems (CMS) like WordPress to simplify content creation, publishing, and organization.

- Automation tools: Implement automation tools for tasks such as social media scheduling, email marketing, and website backups, freeing up time for content creation and audience engagement.

- Analytics and data tracking: Employ analytics tools to track website traffic, user behavior, and content performance, informing data-driven decisions for optimizing your blog.

- Outsourcing and delegation: Consider outsourcing or delegating tasks like content creation, graphic design, or administrative tasks to scale your operations effectively.

Staying Updated with Industry Trends

The personal finance landscape is constantly evolving, with new trends, technologies, and best practices emerging regularly. To maintain a competitive edge and ensure your blog remains relevant, it's crucial to:

- Follow industry news and publications to stay informed about the latest developments in personal finance, blogging, and digital marketing.

- Participate in online communities, forums, and networking events to exchange ideas and learn from other professionals in the field.

- Continuously educate yourself by taking courses, attending workshops, or seeking mentorship opportunities to enhance your skills and knowledge.

- Adapt and innovate by experimenting with new content formats, marketing strategies, or monetization models that align with emerging trends and your audience's preferences.